Cqf Finance Program

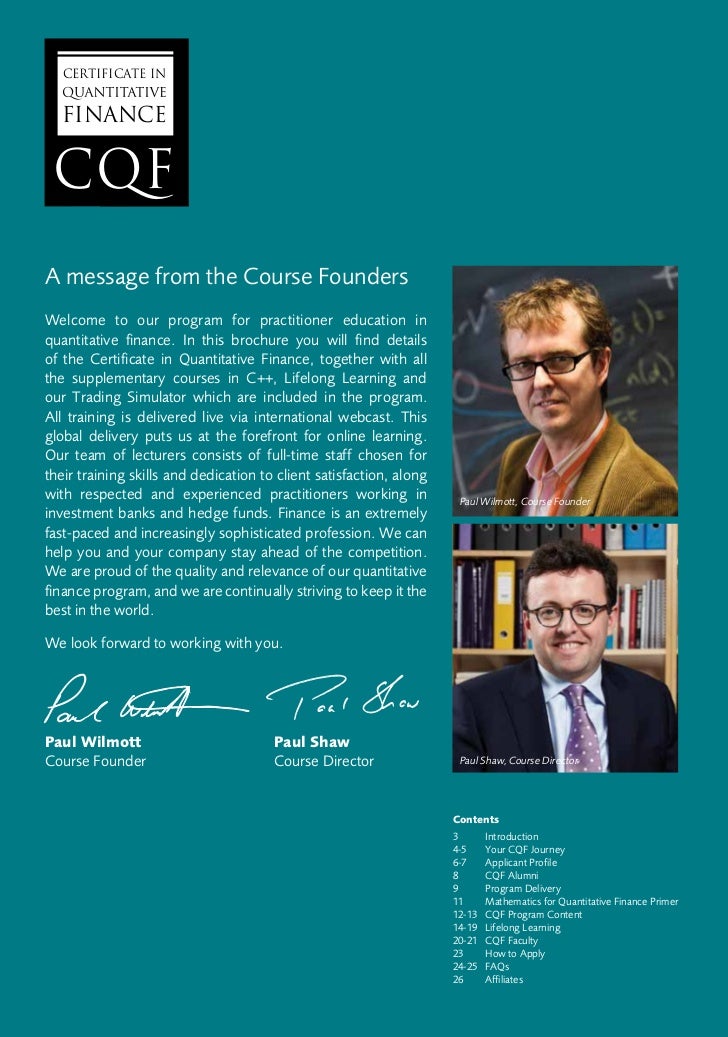

10032021 CQF and the CQF Institute About the Certificate in Quantitative Finance CQF The CQF Program is an internationally recognised professional qualification founded by Dr Paul Wilmott designed to help professionals advance in derivatives risk management model validation valuations quant IT and trading. The program is taught by leading practitioners and renowned academics and focuses on the practical implementation of quant techniques to help.

Http Www Ams Org Notices 200809 Tx080901095p Pdf

It is designed for in-depth training for professionals and students who want to make their career in derivatives IT quantitative trading insurance financial model.

Cqf finance program. The designation is aimed at providing a high level training for professionals working in or intending to move into derivatives and risk management. This six-month intensive program consists of straight-to-the-point formal evening lectures and other more. Our Lifelong Learning program lets you keep pace with the latest thinking in your field and arms you with the knowledge to excel for the rest of your career.

Established in 2003 by leading quant finance expert Dr. With over 900 hours of lectures and masterclasses on every conceivable finance subject this rich resource is ever-expanding with exciting new features on. Educating the quantitative finance community Promoting the highest standard in practical financial engineering the CQF Institute provides a platform for educating and building the quantitative finance community around the globe.

17032021 The Certificate in Quantitative Finance CQF is the flagship professional qualification delivered exclusively by Fitch Learning. Paul Wilmott the CQF is an internationally renowned qualification ideal for aspiring and established professionals who want to advance in the increasingly complex quantitative finance industry. The CQF qualification is comprised of six modules and two advanced electives selected from 14 which along with three exams and a final project need to be completed to gain the CQF qualification.

The CQF is a lower cost course compared to other Quant programmes but its not a cheap course coming in at close to 14k for a six months course it is quite steep. A fully inclusive program. The CQF is an intensive mathematical finance program consisting of formal lectures and workshops delivering the necessary knowledge base and skills needed to succeed in the fast-paced environment of the financial markets.

Paul Wilmott the online CQF program teaches real-world financial engineering and focuses on practical quant techniques used by industry professionals. Designed to benefit both those who are working in the industry and seeking a refresher and those who have no experience within financial services but may be looking to move into this type of role this ten-hour primer lays the foundations youll need to succeed. To find out more about the CQF book your place at one of our International Information Sessions presented by Paul Wilmott.

The program consists of 6 modules which each cover a different area of quantitative finance. Making the investment in the CQF is a career-changing decision. The course offers various insights and allows multiple programming languages.

The CQF qualification is made up of six modules two chosen advanced electives three exams and a final project. Taught by leading practitioners in the field our curriculum is updated every 3 months to reflect the latest industry practices ensuring that you will get the latest quant education. It has a wonderful faculty most of whom are former PhDs from Stanford or Professors in Indian Statistical Institute ISI.

With our new financing options for self-funded residents of the USA or Canada that decision is now easier to make as you can choose to either spread the payments over time or pay in full prior to the start of the program. You can follow the Full Program or take Level I and then Level II to achieve the qualification. Check out results for How to refinance home loan.

Ever-increasing range of generalist financial courses the CQF is unique in its structured approach and commitment to the field of practical quantitative finance. The CQF program is designed to meet the practical needs of professionals working in financial markets. Each exam is a practical assessment of the knowledge and skills youve learned.

27102016 CFA is the short form used for Chartered Financial Analyst and this degree can be pursued by individuals who want career advancement and are interested in showcasing their knowledge and skills by specializing themselves in finance whereas the full form for CQF is Certificate in Quantitative Finance and this course allows aspirants to secure relevant jobs in. Option 1 - Full Program. 09102016 FRM is the short form used for Financial Risk Manager and an individual with this degree can apply for jobs in industries like IT Banks KPOs Hedge Funds etc whereas CQF is the short form used for The Certificate in Quantitative Finance and this course does not really offer any placement but the individuals with this degree can secure better jobs in finance hedge funds.

The Wilmott CQF Finance certificate in quantitative finance was designed by Doctor Paul Wilmott in 2003. Check out results for How to refinance home loan. Much more rigorous than CQF and more Quant Finance orientated than a CFA.

15092016 CQF is a part-time financial engineering program that is delivered and taken online. Finance Primer This primer introduces the key concepts and different asset classes needed for the CQF program. Each module covers a different aspect of quant finance and consists of lectures workshops optional exercises and online discussions.

25022010 After a few years in the industry I decided to do the CQF for fun - I thought its only a six month program and would be good to formalise my knowledge in finance.

Cfa Vs Cqf Which Program Should You Enroll For Wallstreetmojo

Cfa Vs Cqf Which Program Should You Enroll For Wallstreetmojo

Charles S Professional Blog My Cqf Results

Github Michaelfein56 Cqf Finalproject Certificate In Quantitative Finance Final Project

Cqf Final Results Letter Jan 13

Cqf Final Results Letter Jan 13

Cfa Vs Cqf Which Program Should You Enroll For Wallstreetmojo

Cfa Vs Cqf Which Program Should You Enroll For Wallstreetmojo

Quant Insights Conference 2020 Wilmott

Quant Insights Conference 2020 Wilmott

Cqf Institute Cqfinstitute Twitter

Cqf Institute Cqfinstitute Twitter

Cfa Vs Cqf Which Program Should You Enroll For Wallstreetmojo

Cfa Vs Cqf Which Program Should You Enroll For Wallstreetmojo

Insights Into Quant Finance And Careers From The Cqf Cqf

Insights Into Quant Finance And Careers From The Cqf Cqf

Https Www Cfasociety Org Ireland Presentations 20articles Cqf 20for 20cfa 20charterholders Dublin 202010 Pdf

Insights Into Quant Finance And Careers From The Cqf Cqf

Insights Into Quant Finance And Careers From The Cqf Cqf

Notes For Cqf Problem Session Part Iv Wenchao Quant Blog

Notes For Cqf Problem Session Part Iv Wenchao Quant Blog

0 Response to "Cqf Finance Program"

Post a Comment