Finance Bill 2013 Uk

The Finance Bill 2013 seeks to prescribe the rates of income-tax on income liable to tax for the assessment year 2013-14. Bill 190 I 553 Finance No.

No Revolution Says The Supreme Court As It Rules On Defamation Uk Human Rights Blog

No Revolution Says The Supreme Court As It Rules On Defamation Uk Human Rights Blog

24072013 This page sets out information on and documents supporting the passage of Finance Bill 2013 between June and July 2013.

Finance bill 2013 uk. 1 This Act may be called the Finance Act 2013. These were published in Chapter 1 of the Overview of tax legislation and rates document which also sets out where changes were. 19 December 2013 at 1038.

EUROPEAN CONVENTION ON HUMAN RIGHTS Mr Chancellor of the Exchequer has made the following statement under section 191a of the Human Rights Act 1998. DETAILS OF THE AMENDMENT 2. 3 The general anti-abuse rule applies to the following taxes.

2 The rules of this Part are collectively to be known as the general anti-abuse rule. A full analysis of each and every measure introduced by the Finance Bill is beyond the scope of this Alert but we aim to highlight some of the key measures introduced. 2 Bill This Bill is divided into two volumes.

HM Treasury and HM Revenue. A Bill To grant certain duties to alter other duties and to amend the law relating to the National Debt and the Public Revenue and to make further provision in connection with finance. 1 This Part has effect for the purpose of counteracting tax advantages arising from tax arrangements that are abusive.

Schedule 10 introduced by lause 26 c makes changes to the transfer. BE it enacted by Parliament in the Sixty-fourth Year of the Republic of India as follows CHAPTER I PRELIMINARY 1. 25112015 The Finance Bill is the vehicle for renewing annual taxes delivering new tax proposals and maintaining administration of the tax system.

18122013 Government Bill Originated in the House of Commons Sessions 2012-13 2013-14 Last updated. Volume II contains Schedules 7 to 34. ON 28TH FEBRUARY 2013 Bill No18 of 2013 THE FINANCE BILL 2013 A BILL to give effect to the financial proposals of the Central Government for the financial year 2013-2014.

26 June 2013 The government tabled new clauses and amendments for Report. New paragraph 4 4. Part 2 of Schedule 16 is amended to allow for a specified date for commencement of the new relief.

05122013 The government is committed to confirming the majority of Finance Bill measures at least three months prior to its introduction to Parliament and. 11122013 The UK Finance Bill 2014 was published in draft form on 10th December 2013 and the proposed legislation now enters a period of consultation which will end on 4th February 2014. The rates at which tax will be deductible at source during the financial year 2013-14 from interest including interest.

Consequential amendments for other parts of the Taxes Acts as specified in Schedule 17 are amended to take into account the effects of the amendments in Schedule 16. 15052013 Budget 2013 confirmed measures to be included in Finance Bill 2013. TRANSFER OF ASSETS ABROAD.

08052013 Finance Bill Part 1 Income Tax Corporation Tax and Capital Gains Tax Chapter 3 Corporation tax. Financial Services Banking Reform Act 2013. Text created by the government department responsible for the subject matter of the Act to explain what the Act sets out to achieve and to make the Act accessible to readers who are not legally qualified.

206 General anti-abuse rule. FINANCE BILL 2013 EXPLANATORY NOTE CLAUSE 26 SCHEDULE 10. Volume I contains the Clauses and Schedules 1 to 6.

We Your Majestys most dutiful and loyal subjects the Commons of the United Kingdom in Parliament assembled towards raising the necessary supplies to defray Your Majestys public expenses and making an addition to the public revenue have freely and voluntarily resolved to give and grant unto Your Majesty the several duties hereinafter mentioned and do therefore most. 11032021 The Finance Bill puts into law measures announced at Budget to help ensure millions of jobs and livelihoods continue to be protected as part of the governments Plan for Jobs. A Bill to grant certain duties to alter other duties and to amend the law relating to the national debt and the public revenue and to make further provision in connection with finance.

Financial Privilege The Constitution Unit Ucl University College London

Financial Privilege The Constitution Unit Ucl University College London

Barbados 100 Dollar Bill Totally Barbados Dollar Dollar Bill 100 Dollar Bill

Barbados 100 Dollar Bill Totally Barbados Dollar Dollar Bill 100 Dollar Bill

Pdf The Reform Of Uk Financial Regulation

Pdf The Reform Of Uk Financial Regulation

Tax Avoidance A General Anti Abuse Rule House Of Commons Library

Tax Avoidance A General Anti Abuse Rule House Of Commons Library

Dormant Company Meaning Eligibility Procedure Legalraasta

Dormant Company Meaning Eligibility Procedure Legalraasta

Https Www Gov Uk Government Uploads System Uploads Attachment Data File 192135 Vat Supplies Public Bodies Pdf

Pdf Directors Remuneration And Corporate Governance Within The Uk

Pdf Directors Remuneration And Corporate Governance Within The Uk

Royals Vetted More Than 1 000 Laws Via Queen S Consent The Queen The Guardian

Royals Vetted More Than 1 000 Laws Via Queen S Consent The Queen The Guardian

Https Www Gov Uk Government Uploads System Uploads Attachment Data File 192134 Vat Grouping Esc Pdf

Pdf Legal And Regulatory Issues Of Islamic Finance In Australia

Pdf Legal And Regulatory Issues Of Islamic Finance In Australia

Pdf The Liability Of Financial Supervisory Authorities Donal Nolan Academia Edu

Pdf The Liability Of Financial Supervisory Authorities Donal Nolan Academia Edu

Project Manager Cv Sample 1 Good Cv Business Analyst Resume Project Manager Resume

Project Manager Cv Sample 1 Good Cv Business Analyst Resume Project Manager Resume

Dissertation Accounting And Finance Overview Established In 1973 The Msc Finance And Investme Architect Resume Sample Graphic Design Resume Marketing Resume

Dissertation Accounting And Finance Overview Established In 1973 The Msc Finance And Investme Architect Resume Sample Graphic Design Resume Marketing Resume

Parliamentary Commission On Banking Standards House Of Lords Library

Parliamentary Commission On Banking Standards House Of Lords Library

Pre Incorporation Contracts As Per Companies Act 2013 Khanna Associ

Pre Incorporation Contracts As Per Companies Act 2013 Khanna Associ

Http Researchbriefings Files Parliament Uk Documents Sn03697 Sn03697 Pdf

Pdf The Land Acquisition Rfctlarr Act 2013 The Antecedents And Precedents

Pdf The Land Acquisition Rfctlarr Act 2013 The Antecedents And Precedents

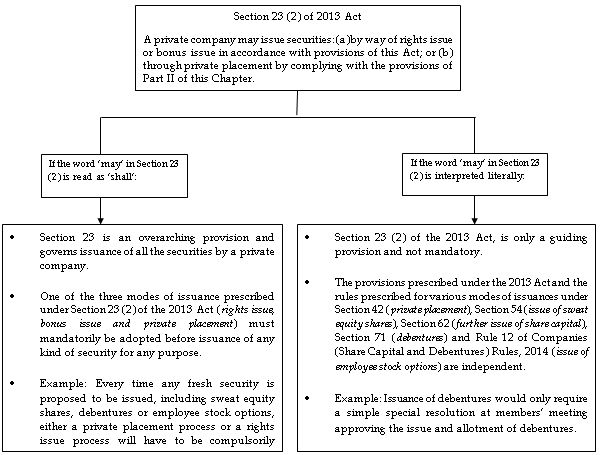

India Companies Act 2013 Section 23 What May Be Corporate Commercial Law India

India Companies Act 2013 Section 23 What May Be Corporate Commercial Law India

Singaporean 5 Dollar Bill Singapore Currency Green Bill Etsy In 2021 Bank Notes 5 Dollar Bill Dollar

Singaporean 5 Dollar Bill Singapore Currency Green Bill Etsy In 2021 Bank Notes 5 Dollar Bill Dollar

0 Response to "Finance Bill 2013 Uk"

Post a Comment