Finance Efficient Market

When the information that investors need to make investment decisions is widely available thoroughly analyzed and regularly used the result is an efficient market. 26032020 An efficient market is one in which the prices of the assets traded in it reflect at all times the information available on the market.

According to Fama1970 efficient markets are.

Finance efficient market. When the information is released the different market agents analyze it and use it to make decisions. The hypothesis that all regulated financial market s are efficient market s. That means the price of a security is a clear indication of its value at the time it is traded.

Instant industry overview Market sizing forecast key players trends. Efficiency of the financial market interms of the overwhelming information news or communication involved. Financial asset prices react strongly to market information.

It is believed that the markets are extremely efficient that individual stocks and stock markets as a whole are fully reflected by all available information. Corporate FinanceMarket Reports from 10000 trusted sources. 03012020 Efficient market theory or hypothesis holds that a securitys price reflects all relevant and known information about that asset.

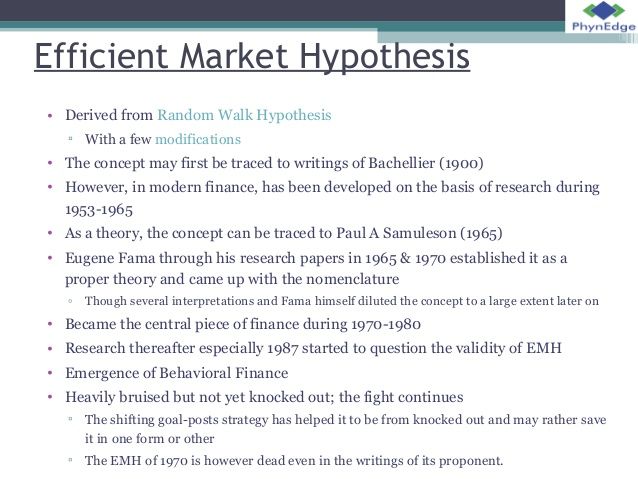

This is the case with securities traded on the major US stock markets. Behavioral Finance and Efficient Market Hypothesis have different kinds of perceptions of the financial literature. It was developed independently by Samuelson 1965 and Fama 1963 1965 and in a short time it became a guiding light not only to practitioners but also to academics.

Corporate FinanceMarket Reports from 10000 trusted sources. Ad Download Accounting. The efficient market hypothesis EMH is one of the milestones in the modern financial theory.

Efficient market hypothesis r. 73 Such efficiency is achieved only when financial markets are both developed and stable. 06122019 As defined in his article the efficient market is the market where securities are priced at any point of time by accessible information.

Ad Download Accounting. 74 Although these concepts are already defined in the current GCI the measurement of some of their elements has improved and the 200809 financial. An efficient financial market is characterized by prices that reflect all available public information a lack of bubbles the capacity to manage risks through hedging and the tendency to allocate savings to their most productive investment uses.

If markets are efficient then all information. Instant industry overview Market sizing forecast key players trends. Market efficiency refers to the degree to which market prices reflect all available relevant information.

Together they constitute the efficient market hypothesis EMH a hypothesis that was first formulated by Eugene Fama. One upshot of this theory is that on a risk-adjusted basis you cant consistently beat the marketThe theory which is controversial has significant implications for investment strategy. This means that it is very hard or impossible to earn positive risk-adjusted abnormal returns.

While the efficient market hypothesis supports that people are. The market efficiency hypothesis states that financial markets incorporate relevant information very quickly. Efficient Market Theory Developed by University of Chicago professor Eugen Fama in the 1960s the efficient market theory states that at any given time all available information is fully reflected in securities prices.

Does Warren Buffett Believe In The Efficient Market Hypothesis Efficient Market Hypothesis Hypothesis Warren Buffett

Does Warren Buffett Believe In The Efficient Market Hypothesis Efficient Market Hypothesis Hypothesis Warren Buffett

19 Lessons From The Best Books On Finance In 2021 Finance Finance Books Good Books

19 Lessons From The Best Books On Finance In 2021 Finance Finance Books Good Books

Efficient Markets Hypothesis Historic Timeline Efficient Market Hypothesis Hypothesis Marketing

Efficient Markets Hypothesis Historic Timeline Efficient Market Hypothesis Hypothesis Marketing

Sometimes The Market Is Wrong Morningstar Efficient Market Hypothesis Marketing Financial Information

Sometimes The Market Is Wrong Morningstar Efficient Market Hypothesis Marketing Financial Information

From Standard Finance To Behavioural Finance Finance Efficient Market Hypothesis Prospect Theory

From Standard Finance To Behavioural Finance Finance Efficient Market Hypothesis Prospect Theory

Are You Wasting Your Time With Stock Picking Maybe Find Out Your Chances Of Beating The Returns Of Th Stock Market Stock Market Investing Investing Strategy

Are You Wasting Your Time With Stock Picking Maybe Find Out Your Chances Of Beating The Returns Of Th Stock Market Stock Market Investing Investing Strategy

Efficient Market Hypothesis And Bitcoin Stock To Flow Model Efficient Market Hypothesis Bitcoin Hypothesis

Efficient Market Hypothesis And Bitcoin Stock To Flow Model Efficient Market Hypothesis Bitcoin Hypothesis

Efficient Markets Hypothesis Explanation Efficient Market Hypothesis Hypothesis Marketing

Efficient Markets Hypothesis Explanation Efficient Market Hypothesis Hypothesis Marketing

19 Lessons From The Best Books On Finance Your Financial Toolkit Finance Books Finance Show Me The Money

19 Lessons From The Best Books On Finance Your Financial Toolkit Finance Books Finance Show Me The Money

The Method To Determine The Best Position On The Efficient Frontier Line Is The Capital Modern Portfolio Theory Financial Statement Analysis Positive Cash Flow

The Method To Determine The Best Position On The Efficient Frontier Line Is The Capital Modern Portfolio Theory Financial Statement Analysis Positive Cash Flow

19 Lessons From The Best Books On Finance Finance Finance Books Good Books

19 Lessons From The Best Books On Finance Finance Finance Books Good Books

Cartoon 42 Efficient Market Hypothesis And Cryptocurrency Prices Efficient Market Hypothesis Cryptocurrency Hypothesis

Cartoon 42 Efficient Market Hypothesis And Cryptocurrency Prices Efficient Market Hypothesis Cryptocurrency Hypothesis

Efficient Market Hypothesis Wikipedia The Free Encyclopedia Efficient Market Hypothesis Stock Market Earnings

Efficient Market Hypothesis Wikipedia The Free Encyclopedia Efficient Market Hypothesis Stock Market Earnings

Random Walk Efficient Market Hypothesis A Random Walk Down Wall Street Animated A Random Walk Down Wall Street A Random Walk Down Wall Street Summary A Ran

Random Walk Efficient Market Hypothesis A Random Walk Down Wall Street Animated A Random Walk Down Wall Street A Random Walk Down Wall Street Summary A Ran

Do You Believe In Some Form Of Efficient Market Hypothesis Emh Your Belief Will Drive Your Investment Stra Efficient Market Hypothesis Hypothesis Efficiency

Do You Believe In Some Form Of Efficient Market Hypothesis Emh Your Belief Will Drive Your Investment Stra Efficient Market Hypothesis Hypothesis Efficiency

Our Ebooks Student Essay Writing Efficient Market Hypothesis

Our Ebooks Student Essay Writing Efficient Market Hypothesis

Jeremy Siegel Efficient Market Theory And The Recent Financial Crisis Marketing Efficient Market Hypothesis Business Finance

Jeremy Siegel Efficient Market Theory And The Recent Financial Crisis Marketing Efficient Market Hypothesis Business Finance

Efficient Market Hypothesis Explains Why It Is Hard To Beat The Market Efficient Market Hypothesis Hypothesis Marketing

Efficient Market Hypothesis Explains Why It Is Hard To Beat The Market Efficient Market Hypothesis Hypothesis Marketing

My Ebay Active Financial Markets Efficient Market Hypothesis Economic Analysis

My Ebay Active Financial Markets Efficient Market Hypothesis Economic Analysis

0 Response to "Finance Efficient Market"

Post a Comment